The Home Loan EMI Calculator 2025 has now formed an important digital accessory for individuals who want to buy some houses. In the face of increasing costs of property and altered interest rates, this calculator give borrowers an instant estimate of precisely how much they need to pay every month, further simplifying and clarifying the financial process.

What Is A Home Loan EMI Calculator?

A Home Loan EMI Calculator is an online tool used to know the computation of the EMI monthly installment. By filling the loan amount, interest rate, and tenure details, borrowers will immediately be able to see his repayment schedule. The 2025 version offers enhanced features for improved results in an attractive design that makes user-friendliness its paramount quality.

Why It Is Important In 2025?

Banks make it official on their site several times over time, requiring a borrower to question how much they need to pay each month. The EMI calculator provides clarity on this as families make time to plan and live within advance budgets. Besides, this provides capability to check the rates offered by various banks or financing companies and choose the novel and sagacious offer available.

Significant Features of Home Loan EMI Calculator 2025

The calculator now has in-time results, repayment charts displayed graphically, and facility for additional prepayment into account–covering more users online on mobiles and websites for easy usage across India.

Summary of Home Loan EMI Calculator 2025

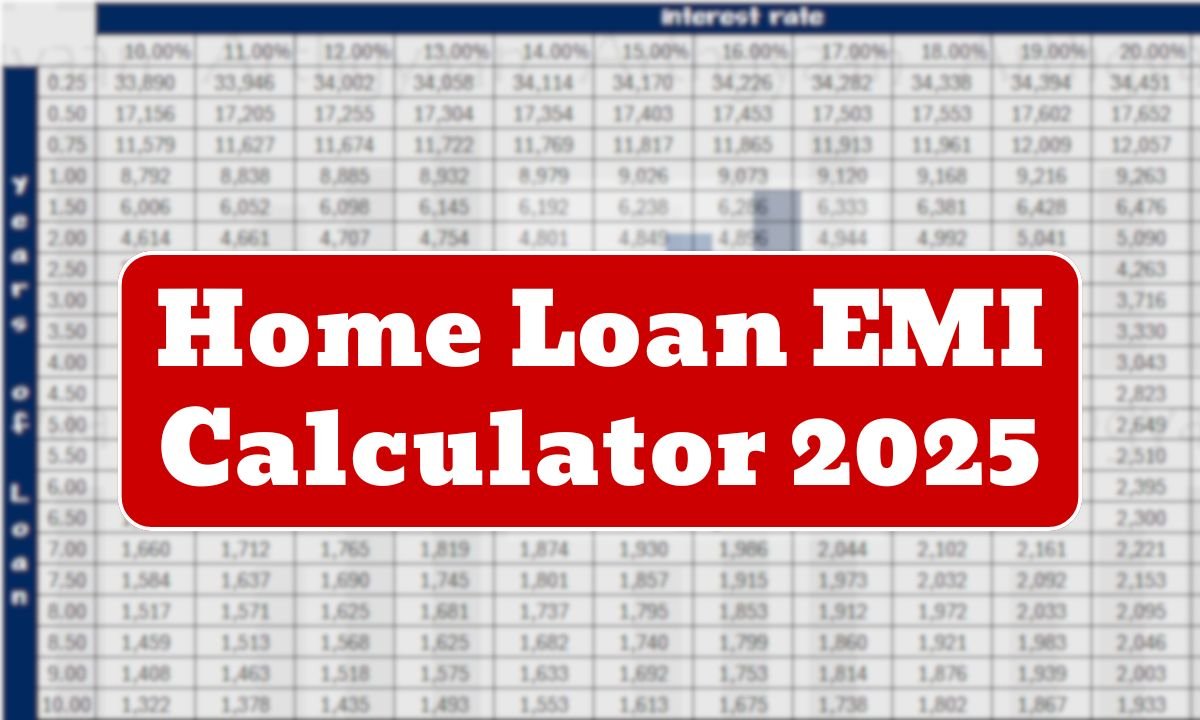

Here is a simple table highlighting the major features:

| Feature | Details |

|---|---|

| Input Required | Loan amount, interest rate, tenure |

| Output Provided | Monthly EMI, total interest, total repayment |

| Accessibility | Available on bank websites & apps |

| Prepayment Option | Allows calculation of reduced EMIs |

| Graphical View | Pie chart showing principal vs interest |

| Accuracy | Real-time updates with latest interest rates |

Benefits to Customers

Users like it as they get transparency. The calculator is a user’s guide through which he understands the share of principal payments and interest payments. Calculation helps the user choose between a lengthy time period as one alternative and shorter time as another. Its circuits thus fulfill the objective of obtaining a relatively lower rate of interest.

Impact on Bank

Benefiting the banks is that it toes the line vis-à-vis the somewhat ostracized obligation of repayment which disheartens the consumer through loan processing where the machine predominantly satisfies the calculiterals of homeownership funding with feasibility.

Conclusion

The estimated EMI for a home loan in 2025 stands as a boon for any person with a purchase thought about a property. Giving instant, accurate results, and user-friendly calculations make it easy to plan your finances and thus well enable the borrowers to make wise decisions. Prepayment options and repayment graphs feature this tool, which will be the ultimate must-use helper in 2025, to fulfill housing dreams.